How to Create the Perfect Startup Pitch Deck (+Template & Download)

Dec 05, 2024

How to Make a Startup Investor Pitch Deck: A Comprehensive Guide

A startup pitch deck is a crucial tool for raising funds, aligning your vision, and winning over investors. Crafting the perfect pitch deck for early-stage entrepreneurs requires clarity, structure, and a compelling narrative.

Whether you’re looking to showcase your business idea to angel investors, secure a VC investment, or close your next funding round, this guide will help you create a powerful pitch deck that communicates your vision effectively.

What Is a Startup Pitch Deck?

A startup pitch deck is a brief, visual slide deck designed to provide an engaging overview of your business. It’s your chance to tell your story, showcasing your product, target market, business model, track record, and funding requirements. This essential tool plays a pivotal role in startup fundraising, helping you stand out and show the investor why your business is worth their attention and capital.

Whether you’re pitching to angel investors or venture capitalists, your slide deck should be concise, visually compelling, and to the point. Think of it as your opportunity to make it memorable by clearly articulating your vision, differentiation, and growth potential. A well-crafted pitch deck not only captures interest but also sets the foundation for meaningful discussions with stakeholders.

What Slides to Include in a Great Startup Pitch Deck?

Cover Slide

- Introduce your startup with a polished, professional design.

- Include your company name, logo, and tagline.

- Add a compelling visual or a bold statement to grab attention. For example: “Revolutionizing Collaboration for Remote Teams.”

- Keep it clean and memorable—this sets the tone for your presentation.

Problem Statement

- Identify the specific problem your product or service solves.

- Use real-world examples or data to highlight the pain point. For instance: “80% of small businesses struggle with cash flow management.”

- Explain why this problem matters and how it impacts your target market.

- Keep it concise but ensure the problem is relatable to your audience.

Solution

- Present your product or service as the ideal solution to the problem.

- Include key features and a unique value proposition that make your solution stand out.

- Visuals matter—showcase a demo, prototype, or screenshots to make your solution tangible.

- Example: “Our AI-powered dashboard predicts cash flow issues 3 months in advance.”

Market Opportunity

- Dive deeper into the size and growth potential of your market.

- Use metrics like Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

- For example: “A $5B market growing at 15% annually, with $1B accessible to us in the next 3 years.”

- Charts and graphs can make this slide visually impactful.

Business Model

- Show exactly how your business generates revenue.

- Include pricing structures, subscription plans, and potential upsell opportunities.

- Highlight current revenue or potential revenue streams: “We operate on a SaaS model with a $50 monthly subscription fee.”

- If applicable, explain unit economics or customer lifetime value (CLV).

Go-to-Market (GTM) Strategy

- Explain how you plan to attract, acquire, and retain customers.

- Outline the sales channels (direct sales, e-commerce, etc.) and marketing strategies (content marketing, paid ads, partnerships).

- Include key milestones, such as: “Launch partnerships with X and Y by Q2 2025.”

- Link to a deeper guide if you have a resource available for download.

Traction and Milestones

- Showcase your progress to date with data like revenue, user growth, or downloads.

- Example: “1,000 active users within 6 months, generating $20K MRR.”

- Highlight endorsements, partnerships, or any notable press coverage.

- Use visuals like timelines to show future milestones.

Competitive Analysis

- Acknowledge your competitors but focus on your strengths.

- Use a comparison table or graph to demonstrate your differentiation.

- Example: “Unlike competitors, we offer integration with 100+ tools and a no-code setup.”

- Investors want to see you’re aware of the market landscape and have a clear competitive edge.

Product Roadmap: A Clear Plan for Growth

- Provide a high-level timeline showcasing your product’s development journey and future goals.

- Divide the roadmap into key phases such as research, MVP development, product launch, and upcoming features.

- Use milestones to highlight achievements and upcoming updates. Example: “Q1 2025: Launch new AI-driven analytics module.”

- Connect the roadmap to customer feedback or market demands to demonstrate alignment with user needs.

Example layout:

- Past: MVP launched and beta-tested with 500 users.

- Present: Product live with 2,000 active users; developing integrations.

- Future: Expansion into new markets, additional features, and scaling.

Financial Projections

- Provide a realistic 3-5 year projection of your revenue, expenses, and profitability.

- Use graphs to present figures clearly: “Year 3 projection: $5M ARR with 30% profit margin.”

- Focus on key assumptions driving the projections and link them to your market opportunity and strategy.

Team

- Introduce your core team, advisors, and their expertise.

- Include professional headshots, short bios, and notable accomplishments: “Sarah, CTO, built AI algorithms at Google for 5 years.”

- Highlight how the team’s experience aligns with your startup’s goals.

The Ask

- Be specific and confident about your funding needs: “We’re seeking €1.5M to achieve 18 months of runway.”

- Explain what the funds will enable: “Expand into 3 new markets, hire a sales team, and launch product updates.”

- End this slide with a concise ROI statement for investors: “Projected ROI of 5x within 4 years.”

Use of Funds

- Clearly break down how the requested funding will be allocated.

- Categories might include product development, marketing, hiring, and scaling.

- Example: “40% for product development, 30% for marketing, 20% for operations, and 10% for contingency.”

- Show how the investment will directly drive growth and ROI.

Call to Action

- Finish with a clear, action-oriented statement encouraging the next step.

- Example: “Join us in revolutionizing remote work! Let’s schedule a follow-up meeting to dive deeper.”

- Include your contact information and a thank-you message.

- Make it visually engaging to leave a strong impression.

Benefits of a Well-Crafted Great Pitch Deck

- Attract Investors: A polished pitch deck captures attention and builds trust.

- Clarify Vision: It aligns your team and stakeholders around shared goals.

- Simplify Communication: It makes complex ideas easy to understand and impactful.

- Boost Confidence: A strong deck helps you present with authority.

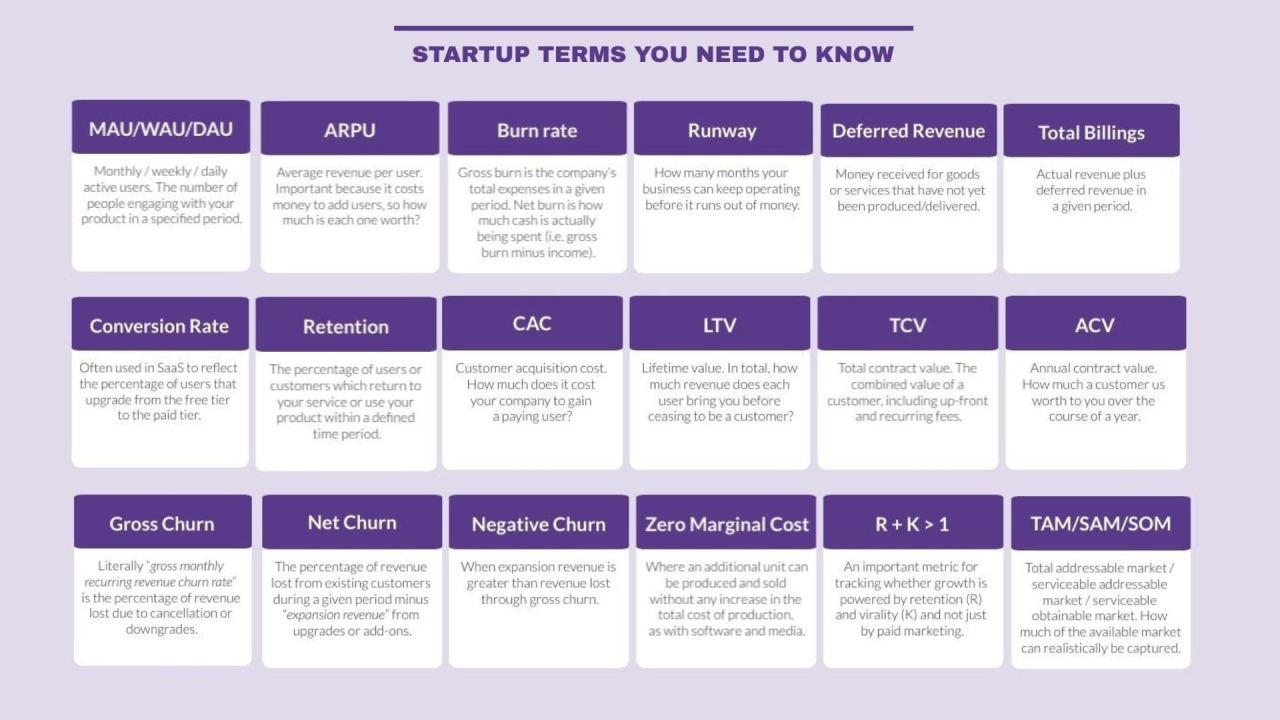

Know Your Metrics: The Backbone of a Strong Fundraising Pitch Deck

Data is the foundation of any successful startup pitch deck for investors. Investors rely on data to assess the viability and potential of your business, and showcasing the right KPIs can make or break your pitch. Highlighting your key performance indicators (KPIs) demonstrates that you have a data-driven approach to growth and are focused on measurable outcomes.

Which Metrics Should You Include?

The specific figures you highlight will depend on your startup’s stage and business model. Below are some essential ones to consider:

Customer Acquisition Cost (CAC):

- Shows how much you spend to acquire a customer.

- Lower CAC indicates efficient marketing and sales processes.

Customer Lifetime Value (CLV):

- Represents the total revenue you expect from a single customer over their engagement with your business.

- Investors will compare CLV to CAC to assess profitability.

Monthly Recurring Revenue (MRR):

- Critical for SaaS businesses, MRR tracks predictable monthly income.

- Showcase trends in MRR growth over time.

Churn Rate:

- Measures how many customers stop using your product or service.

- A low churn rate signals customer satisfaction and product-market fit.

Burn Rate:

- Indicates how quickly your startup is spending funds.

- Helps investors gauge how long you can sustain operations before needing more funding.

Runway:

- Based on your burn rate, this figure indicates how many months your business can operate with its current funding.

- A longer runway gives investors confidence in your financial planning.

User Growth:

- Highlight your growth rate over time.

- Use graphs to show how quickly you’re acquiring new users.

Conversion Rates:

- Include website conversion rates or lead-to-customer conversion rates.

- Demonstrates the effectiveness of your sales funnel.

Engagement Data:

- Track daily active users (DAU) or monthly active users (MAU).

- High engagement indicates that your product is resonating with your audience.

Net Promoter Score (NPS):

- A measure of customer satisfaction and loyalty.

- High NPS scores indicate strong customer advocacy and potential for organic growth.

Why Metrics Matter in a Perfect Pitch Deck

- Build Credibility: Provide concrete evidence of your business’s performance and potential.

- Showcase Traction: Highlighting growth trends reassures investors that your business is scaling effectively.

- Guide Funding Decisions: Clear data highlights where the funds will be allocated and their impact on growth.

- Differentiate Your Business: Demonstrating a deep understanding of your numbers sets you apart from competitors.

How to Present Metrics Effectively: Keep It Simple

- Use graphs and visuals to make data digestible.

- Focus on the most impactful KPIs relevant to your business model and funding stage.

- Avoid overwhelming slides with too many numbers; keep it concise and meaningful.

- Include a slide with Key KPIs and trends to show how your startup is progressing.

By knowing and presenting your data effectively, you can build investor confidence and create a compelling narrative about your startup’s potential. Highlighting data-driven insights in your startup pitch deck is essential to demonstrating readiness for growth and securing funding.

Competitive Advantage: Showcasing Your Startup’s Worth

When crafting your pitch deck, effectively communicating your startup’s competitive advantage is essential for convincing investors of your business’s potential and unique position in the market.

Establish Your Valuation:

Explain your reasoning in a way that aligns with your financial projections and market opportunity. Reference industry benchmarks, comparable companies, or recent funding rounds in your sector to validate your numbers. Clearly articulate how your startup’s growth potential, traction, and scalability justify the valuation.

Highlight Your Competitive Advantage:

Demonstrate what sets your startup apart. This could include:

- Unique Value Proposition: What problem are you solving better than anyone else?

- Proprietary Technology or IP: Highlight innovations that are hard to replicate.

- Market Positioning: Showcase why your approach is more effective or efficient than competitors’.

- Barriers to Entry: Emphasize aspects like patents, exclusive partnerships, or established customer loyalty that protect your business from being easily disrupted.

Back It Up with Metrics:

Include key figures like customer acquisition cost (CAC), lifetime value (LTV), gross margins, and churn rates to substantiate your valuation and competitive claims. These numbers build investor confidence by showing measurable traction and efficiency.

Connect Valuation to Fundraising Goals:

Tie your funding ask directly to measurable outcomes, such as entering new markets, scaling customer acquisition, or accelerating product development. This connection reinforces the rationale behind your competitive edge and investment potential. By effectively presenting your business’s value and strengths, you’ll distinguish yourself from other startups in the eyes of investors.

Go-To-Market Strategy: The Roadmap to Scaling Success

A robust GTM strategy is a critical slide in your pitch deck, showcasing how you plan to reach your target audience and generate revenue. Investors want to see a well-thought-out plan that highlights your approach to acquiring customers, achieving market penetration, and scaling your startup.

What to Include in Your GTM Slide:

- Target Market: Identify your ideal customer profiles and key segments. Show that you understand your audience and their pain points.

- Marketing Channels: Outline the channels (digital, outbound, partnerships) you’ll leverage to create awareness and drive conversions.

- Sales Strategy: Demonstrate how you’ll close deals, whether it’s through direct sales, self-service models, or partnerships.

- Positioning and Differentiation: Highlight your unique selling proposition (USP) and explain how it sets you apart from competitors.

- Tie It All Together: Use this slide to connect your GTM strategy to your funding ask. Show how the investment will help execute your GTM plan, whether it’s scaling your sales team, launching targeted campaigns, or expanding into new markets.

Want to Build a Winning GTM Strategy?

Download our Free Go-To-Market Strategy Guide to create a tailored GTM plan for your startup. This comprehensive guide walks you through the essentials of GTM, helping you align your product, marketing, and sales efforts for maximum impact. Download Here

10 Red Flags in a Startup Pitch Deck

Mistakes can undermine even the best ideas. Avoid these pitfalls when crafting your deck:

- Overloaded Slides: Keep slides concise and visually appealing.

- Dissing Competitors: Avoid negative comments about competitors; they can backfire.

- Jargon Overload: Use simple language to convey your message clearly.

- Poor Graphics: Invest in high-quality visuals to enhance professionalism.

- Excessive Financials: Include only top-level financials; save details for follow-up.

- Missing Storytelling: Weave a compelling narrative to connect emotionally.

- No Market Validation: Use real numbers and traction to back your claims.

- Vague Financial Projections: Be realistic and transparent about projections.

- Unclear Differentiation: Clearly explain what sets your product apart.

- Skipping The Ask: Always specify the funding amount and its intended use.

Mistakes to Avoid for Early Founders

As startup founders, enthusiasm is essential, but it’s easy to fall into common traps during presentations:

- Neglecting Rehearsals: Practice thoroughly to deliver a confident pitch.

- Not Anticipating Questions: Prepare for tough questions about your market and financials.

- Overpromising: Stay grounded in realistic growth expectations.

Download Your Free Template with Pitch Deck Included

Ready to craft your perfect pitch deck? Get started with our free pitch deck template here.

With this guide, you’re equipped to build a standout startup pitch deck for investors that highlights your vision, captures attention, and secures funding.

FAQ

What is a pitch deck and why is it important for a startup?

A pitch deck is a visual presentation that provides an overview of your startup and its business plan. It typically consists of a series of slides that outline the key aspects of your business, including your value proposition, target market, and financial projections. The primary purpose of a pitch deck is to convince potential investors to support your venture, making it a crucial tool during the fundraising process. A well-crafted pitch deck can effectively communicate your vision and create a compelling narrative around your business idea.

What should be included in a startup pitch deck?

A comprehensive startup pitch deck should include the following key elements: an introduction to your team, a clear value proposition, an analysis of the Total Addressable Market and market size, details about your business model, traction KPIs, competitive advantage, financial projections, and your GTM strategy. Each slide should be concise and focused, ensuring that the essential information is conveyed without overwhelming the audience. It’s essential to tailor your pitch deck to the specific interests and preferences of your potential investors.

How can I create a pitch deck template for my startup?

To create a pitch deck template, start by outlining the structure you want to follow. You can use tools like PowerPoint or Google Slides to design your template. Begin with a cover slide that includes your company name and logo, followed by an agenda slide that outlines the content of the presentation. Each subsequent slide should correspond to the key elements of your pitch deck, as mentioned earlier. By creating a template, you ensure consistency in design and make it easier to update your pitch deck as your startup evolves.

What is the ideal length for a successful pitch deck?

The ideal length for a successful pitch deck typically ranges between 10 to 15 slides. This length allows you to cover all critical aspects of your startup without overwhelming your audience. Each slide should